From Scammed to Scammer: The Dennis Nguyen Case

Ex-banker Dennis Nguyen: scammed, then scammed others out of nearly AUD$500k. Dive into the timeline, consequences & Aussie bank/crypto context with our interactive report.

This report details the case of Dennis Nguyen, a former Australian bank employee. After falling victim to a cryptocurrency scam himself, Nguyen exploited his insider knowledge to defraud bank customers of nearly AUD$500,000. This interactive summary explores the timeline of his actions, the consequences, and the broader context of banking and cryptocurrency in Australia.

The Catalyst: A Personal Loss

The chain of events began in November 2021. Dennis Nguyen, then an employee at National Australia Bank (NAB), experienced a significant personal financial setback.

Initial Scam:

Nguyen lost approximately AUD$20,000 of his personal savings to a cryptocurrency scam.

This personal loss appears to have been a turning point, leading Nguyen down a path of criminal activity rather than recovery. The very next day, he began to leverage his position and knowledge within the banking system for illicit gains.

The Frauds: A Calculated Deception

Following his personal loss, Nguyen embarked on a series of fraudulent activities, exploiting his access and knowledge at two different banking institutions and later through impersonation. This section details the progression of these frauds.

Frauds at National Australia Bank (NAB)

Immediately after being scammed, Nguyen began his fraudulent activities at NAB:

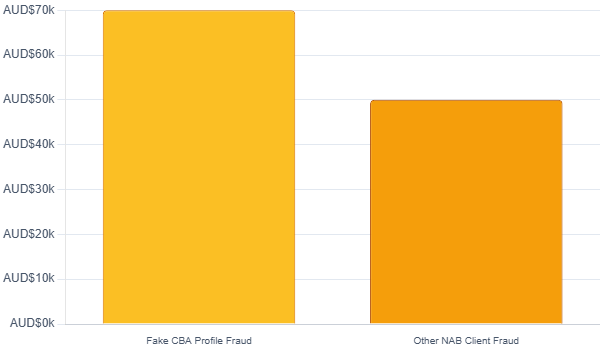

He created a counterfeit Commonwealth Bank profile using real NAB customer data, illicitly transferring AUD$70,000 from a home loan account. The victim was later reimbursed by NAB.

He defrauded another NAB client of AUD$50,000.

NAB dismissed Nguyen on November 26, 2021, and reported him to Victorian Police.

Amounts stolen during employment at NAB.

Timeline of Deception

Nguyen's fraudulent activities spanned approximately 15 months, involving multiple schemes and victims. Here's a simplified overview of the key events:

November 2021: The Trigger

Nguyen loses AUD$20,000 to a crypto scam. 💸

November 2021: NAB Frauds Begin

Day after being scammed, starts defrauding NAB customers.

💰 AUD$70,000 from one customer (later reimbursed).

💰 AUD$50,000 from another customer.

November 26, 2021: Dismissal from NAB

NAB fires Nguyen and reports him to police. 🏢

Post-NAB / Pre-Apprehension: Judo Bank Employment

Secures role at Judo Bank. 🏢

💰 Steals AUD$167,500 from a vulnerable Judo Bank customer.

Judo Bank fires Nguyen and reports him.

Post-Judo Bank: The "Patrick" Persona

Creates fake online profiles as "Patrick," a Judo Bank executive.

💰 Defrauds victims of AUD$200,000 via loan comparison sites.

Over 15 Months: Total Fraud

Total fraudulent activities amount to AUD$489,000.

Sentencing

Pleads guilty; sentenced to 18 months in prison. ⚖️

The Reckoning: Justice Served

Dennis Nguyen pleaded guilty in the Victoria County Court to three charges of theft and four of fraud. His actions, spanning 15 months and involving significant planning and breach of trust, culminated in a prison sentence.

Sentence:

Nguyen was sentenced to 18 months in prison.

During sentencing, Judge Samantha Marks acknowledged Nguyen's difficult personal circumstances, which included a background of paternal alcoholism, gambling addiction, and physical abuse. However, she emphasized the premeditated nature of his crimes.

"Given the gravity of your offending, the sentencing considerations of general deterrence and denunciation are very significant." - Judge Samantha Marks

The judge accepted Nguyen's remorse but underscored the seriousness of his actions in betraying the trust placed in him by his employers and their customers.

The Broader Context: Australian Banks & Cryptocurrency

The Dennis Nguyen case unfolds against a complex backdrop of how Australian traditional banking institutions interact with the cryptocurrency space. While aiming to protect customers, bank policies can sometimes create challenges for legitimate crypto investors.

Banks' Cautious Stance

Many Australian banks maintain stringent policies regarding cryptocurrency transactions. These measures are often implemented to protect customers from the high volatility and scam potential prevalent in the crypto market.

However, this caution can lead to inconveniences for investors, such as:

Frozen assets or accounts involved in crypto transactions.

Blocked transactions to and from cryptocurrency exchanges.

Missed investment opportunities due to delays or blocks.

Example: Andrew Broadbent's Case

Melbourne accountant Andrew Broadbent experienced this firsthand when Commonwealth Bank blocked his AUD$30,000 Bitcoin investment, resulting in financial loss due to missed market movements.

Exploring Web3 Technologies

Despite general caution, some major Australian banks are actively exploring Web3 technologies, indicating a nuanced approach to the digital asset space.

Commonwealth Bank (CBA): Has been involved in Web3 projects since 2016 and has explored services related to cryptocurrency trading for customers (though some initiatives have been paused or re-evaluated).

ANZ Bank: Has successfully tested its Australian dollar-backed stablecoin (A$DC) with partners like Chainlink, demonstrating an interest in blockchain-based financial instruments.

This exploration suggests that while wary of current retail crypto risks, banks recognize the potential of underlying blockchain technology for future financial systems.

Financial Impact: A Summary

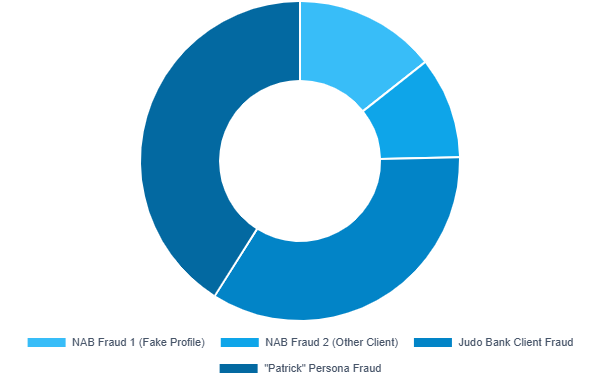

The total amount Dennis Nguyen fraudulently acquired was AUD$489,000. This chart breaks down the amounts by the source or method of fraud. His initial personal loss to a crypto scam was AUD$20,000.

Breakdown of total AUD$489,000 stolen by Dennis Nguyen.